Regardless of whether it’s MENA food & beverage, or general retail order territory, consumers are beginning to see the benefits of the quick commerce business model. It’s a viable solution; efficient, fast, reliable, and growth-oriented for businesses all over the world.

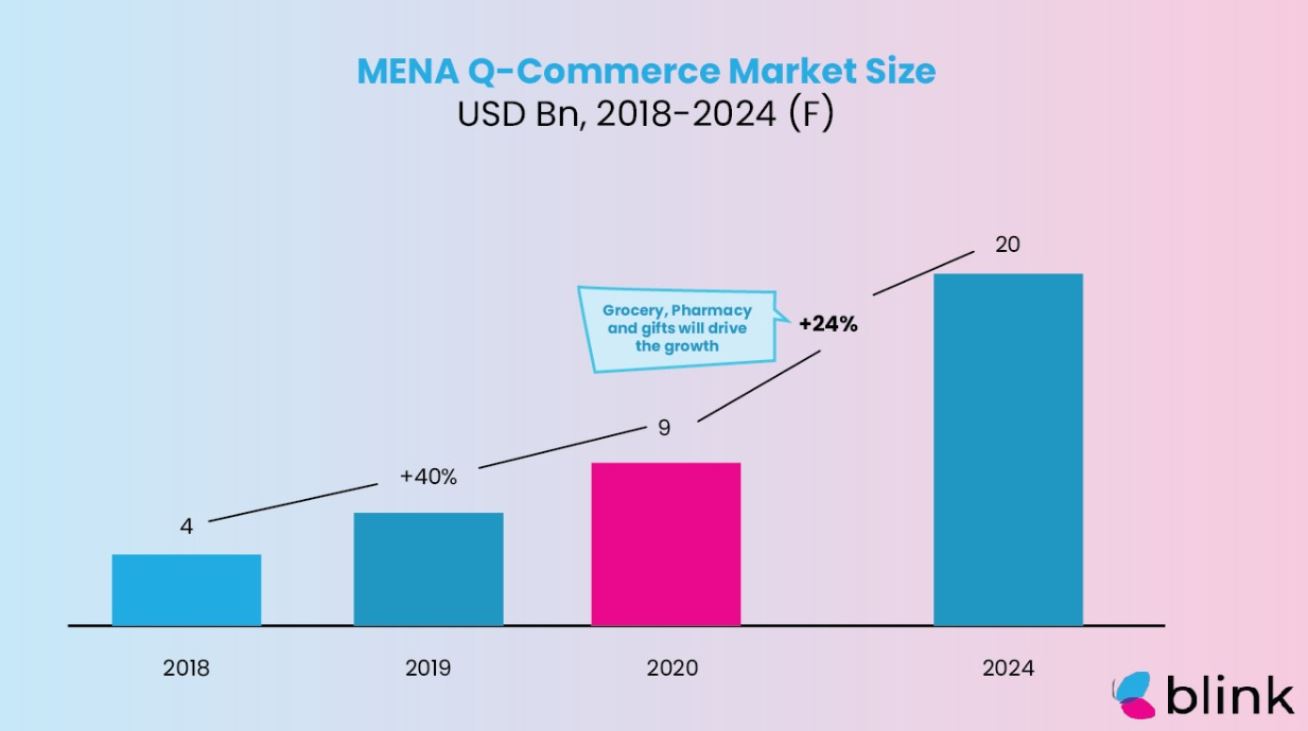

Roughly, 40% of the shoppers in MENA feel that quick delivery platforms are much better than those that offer conventional services. Similarly, MENA’s digital economy is expected to capitalize $20 Billion in the next few years. All thanks to quick commerce enablement platforms in various industry verticals, the trend is not only here to stay, but it will also set up new workflows for upcoming startups.

When we talk about MENA’s revenue growth due to quick commerce trends, it is attributed to various aspects of any business that’s operating in 2021 & beyond. For instance, the 2-hour delivery model is one very important side of the equation for Middle Eastern businesses.

This is so because consumers in that region are affected by the fast order fulfillment process on a business’s behalf. The minimal delivery time also affects an average consumer’s decision-making behavior. The shorter the wait time is, the quicker it’ll help a food business or retail business owner with the conversion process.

A MENA region delivery-oriented business example would be Blink. The online food delivery is facilitated through a direct ordering platform where Blink gives full control to food & retail businesses to forward their deliveries through a multi-locational setup.

In the next 3 years or so, according to a report by RedSeer, MENA’s consumer-based digital economy will double. Some experts argue that if all consumer services industries were to adopt the quick commerce growth spectrum, the digital economy of these businesses will easily surpass $100 Billion.

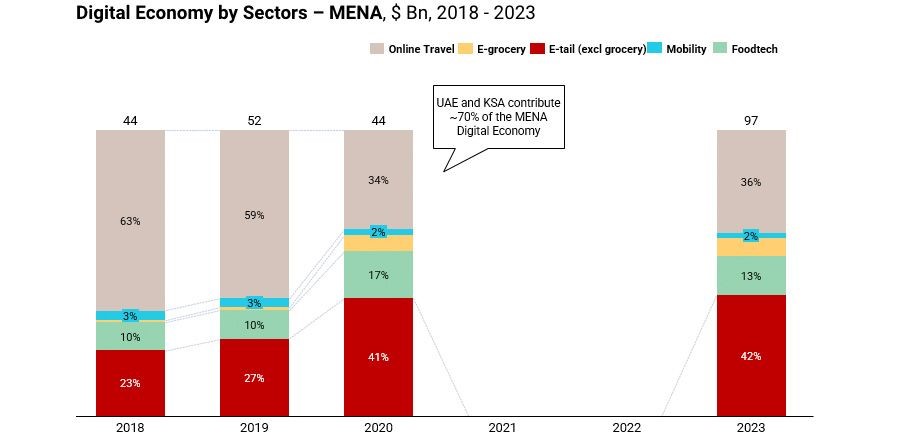

Red Seer has been reportedly tracking the development of consumer and digital economy growth trends for the last few years or so. According to the research firm, businesses in MENA oversaw a growth spurt during the last two years amidst the Coronavirus breakout. Although the pandemic situation rocked the business economy for the first 7 – 8 months, operators were quick enough to realize the potential of transitioning to a dedicated digital services mode.

Since customers and businesses had to comply with healthcare legislation in their respective regions, the operational model for businesses shifted to online services. The digital economic worth of businesses not only doubled due to more and more consumers placing online food, grocery, and retail item order – but it also affected the way how an average customer used to interact with the respective online ordering platform.

Aggregators, such as UberEats, took a hit during the pandemic phase because of the high commission percentages. Since food operators had little to no wiggle room to adjust their profits alongside UberEats’ commissions (*up to 41%) and service charges, the food aggregator had to throw in the towel early.

Relatively speaking, MENA is already punching above its weight limit, since the region is slightly small compared to powerhouse countries, such as; the U.S.A, the U.K., and vice versa. However, since the Middle East was one of the earliest to adopt the quick commerce enablement trend by signing up with payment & trade partners, the revenue growth has been phenomenal to date.

85% of the Middle East population has access to the internet. Meanwhile, 95% of the users in KSA and UAE are already contributing to the digital growth economy by placing their orders through online quick-commerce service-powered websites.

As per Red Seer experts, grocery & retail businesses are part of the MENA region’s quick commerce growth pillar.

Earlier, when we talked about “powerhouse” digital economies, such as the ones from U.S.A and China, the top three market sectors in those regions are also captured by online business models. Also known as the ‘E-Tail’ model; a digitized version of the retail shopper experience, the process alludes to facilitating shoppers with a quick service & turnaround system.

Therefore, if we were to apply the same theory behind E-Tail to the Middle Eastern belt, we can assume that despite having a fragmented economy, the MENA region is already doing well because of how quick commerce has enabled businesses to offer services towards a delightful customer experience.

Key Opportunities For MENA Based Business Operators In Q-Commerce Verticals

Food & Beverage platforms, retailers, cloud-hosted SaaS industries, back-office operations, and many other industries are already benefiting through quick commerce. Similarly, if we take the example of assisted shopping experience where online customers can buy anything from social media profile stores for businesses hosted in the MENA region, we see that since people don’t have to switch tabs between the brands’ website and buy directly from the Facebook, or Instagram store page, it really helps to kick in the growth factor.

This phenomenon is called social commerce; an integrated buying mode that allows online shoppers to make payments directly to the vendor through its respective social media page etc. To that effect. Social commerce plugins are already being developed in MENA to help businesses convert customers into repeat shoppers.

In MENA, the speed and cost of services are two major concerns for business owners. Since there are no Zip Codes in the UAE, fast deliveries are one of the main obstacles that prevent quick commerce-based platforms to fulfill order deliveries in a record time.

All thanks to multi-locational business models, the above issue is resolved by warehouse packing, picking, and replenishment modes. This, in turn, has spiked the demand for warehouse inventory management systems, which is also part of the quick commerce blockchain from a broader perspective.

So, you see, quick commerce growth isn’t about one business working at various forefronts. If we were to take a deep dive into the data-driven metrics, we can identify so many cogs in the machine – all of which are part of the growth spectrum.

A lot of progress has been made through GPS tracking systems for smartphones. Location-based services require an active GPS connection so that the subject’s live location can be monitored effectively. For quick commerce-enabled businesses, this was a huge opportunity.

Blink offers a dedicated fleet management system that owes its growth to the smartphone location technology integration. The result is hundreds of satisfying food, retail, and general order supply business owners who can monitor their delivery agents’ live location on a whim.

The same data can be shared with customers’ at vendors’ discretion – i.e. if online restaurant customers want to see the rider’s real-time location, they can view it in the branded restaurant app that Blink Co. offers its business partners.

The quick commerce ecosystem enjoys very strong and ongoing support from the MENA region governments. The models for operating are business-friendly; the technology is conducive to the growth factor and there’s no reason for businesses to not scale easily these days.

Statistics also back up the transactional pattern for such businesses, as more and more customers are shifting to the online-only shopping experience. Let alone, UAE issued 196 new business licenses to startups in May 2020; all of which is owed to increased consumer-side demand in the E-Tail industry.

As online sales begin to grow in the Middle East and North Africa, so is the value of quick commerce services is becoming increasingly high in demand. It’s only a matter of time until Q-Com becomes the new and fully adapted face of online businesses in the near future.